Hidden damage inspection is a critical initial step for accurate insurance claims, especially in vehicle repair. Using advanced techniques like thermal imaging and ultrasonic scanning, professionals uncover subtle surface anomalies, ensuring fair compensation and streamlining claim settlements. This process builds trust between insureds and insurers by preventing fraud and accurately assessing damage.

Hidden damage inspections play a pivotal role in ensuring accuracy for insurance claims. By meticulously uncovering latent issues often invisible to the naked eye, these inspections prevent fraudulent claims and support fair settlements. This article explores three key aspects: Uncovering Hidden Issues, Precision Assessment, and Preventing Fraud. Understanding the importance of hidden damage inspection is crucial for both insurers and policyholders alike.

- Uncovering Hidden Issues: The Initial Step

- Precision Assessment: Ensuring Claim Accuracy

- Preventing Fraud: The Role of Inspections

Uncovering Hidden Issues: The Initial Step

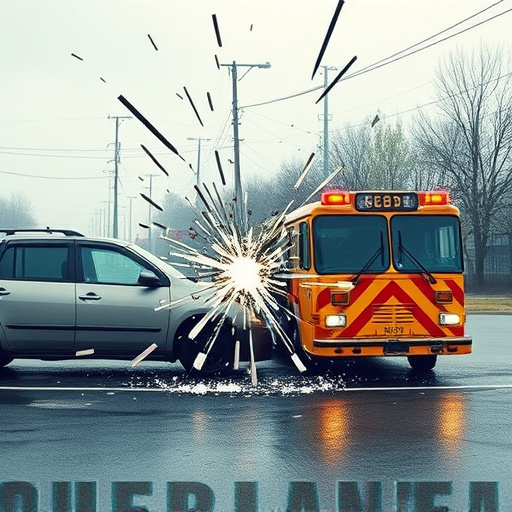

Uncovering hidden issues is a critical initial step in ensuring insurance claim accuracy. Traditional methods often rely on visual inspection, which can miss subtle signs of damage or deterioration that aren’t immediately apparent. This is where hidden damage inspection comes into play. By employing advanced techniques such as thermal imaging and ultrasonic scanning, professionals can detect even the smallest anomalies hidden beneath the surface. These concealed issues could range from cracks in car bodywork to moisture intrusion, both of which are common yet often overlooked during a quick visual assessment.

Hidden damage inspection is particularly valuable for vehicles that have been involved in collisions. A collision center’s expertise in this area ensures that every part of the vehicle—from the frame to the trim—is thoroughly evaluated. This rigorous process not only enhances the accuracy of insurance claims but also facilitates more effective repairs at fleet repair services, ultimately leading to better outcomes for all parties involved.

Precision Assessment: Ensuring Claim Accuracy

Hidden damage inspection plays a pivotal role in ensuring the accuracy of insurance claims, especially when it comes to precision assessment. It involves meticulous examination beyond what meets the eye, delving into the intricate details that could indicate hidden issues within vehicles or structures. By employing advanced techniques and tools, professionals can uncover subtle signs of damage that may have been missed during initial inspections. This comprehensive approach is crucial in the context of vehicle body repair or even assessing the scope of work for collision repair centers.

Through hidden damage inspection, insurance adjusters gain a clearer understanding of the true extent of the loss. It helps prevent instances where claims are under-or over-evaluated. Accurate assessments ensure that policyholders receive fair compensation for valid claims and that insurers mitigate risks associated with fraudulent activities. By integrating this meticulous practice into their processes, insurance companies can uphold their reputation while fostering trust among clients, ultimately streamlining the claim settlement process.

Preventing Fraud: The Role of Inspections

Hidden damage inspections play a pivotal role in maintaining the integrity and accuracy of insurance claims by helping to prevent fraud. During an inspection, skilled professionals meticulously examine a vehicle for any signs of damage that might not be immediately apparent. This includes checking for dents, scratches, and even hidden internal damage caused by collisions. By identifying these concealed issues, inspectors provide crucial evidence that can deter fraudulent claims or ensure accurate assessments in legitimate ones.

For instance, a car scratch repair that seems minor on the surface might indicate a larger problem if the paint is lifted or structural components are affected. Collision repair services rely heavily on these inspections to accurately determine the scope of work required for vehicle repair. This meticulous process helps in avoiding exaggerated claims and ensures that policyholders receive fair compensation for genuine repairs, ultimately strengthening the trust between insureds and insurance providers.

Hidden damage inspection plays a pivotal role in ensuring insurance claim accuracy. By meticulously uncovering and assessing concealed issues, these inspections prevent fraud and promote fairness. Through precise assessments, insurance providers can make informed decisions, leading to faster payouts and better customer satisfaction. This not only streamlines the claims process but also helps maintain the integrity of the insurance industry as a whole.